A month ago, in my blog post titled "Talk About My Understanding of the Financial Market," I briefly discussed my understanding of Bitcoin. Recently, as I have gained more insights into Bitcoin, I have had new thoughts and reflections, which I would like to record in this post.

Historical Perspective: A Democratic Revolution

From the perspective of human history, I am increasingly convinced that Bitcoin will become a great invention, and its historical significance might be comparable to constitutional monarchy. The spread of Bitcoin is an unprecedented attempt at a democratic revolution in human history, and its implications are profound. In a few decades, people may view it as a major force that changed the global landscape.

For thousands of years, human societies have been governed by regional governments, initially to protect the interests of the community. However, the state, as a "violence apparatus," is also a product of class conflicts and struggles. As Marx said, productive forces drive social development, and production relations will change with shifts in productive forces. Today, the information revolution has rapidly advanced productive forces, but the large, bloated form of the state has become outdated and no longer meets the needs of these productive forces. Excessive money printing, debt accumulation, and internal bureaucratic conflicts are depleting the wealth of nations and increasing the entropy of global society.

Bitcoin’s emergence is an attempt to challenge the traditional state system. It provides a new tool for individuals to control their own wealth and offers the world a currency that doesn’t require a government’s endorsement. Governments' resistance to Bitcoin is not accidental, as it challenges the foundational power structure. But history’s wheel cannot turn backward—those trying to block this trend will only appear as ants trying to stop a chariot. Today, countries like the United States have already recognized Bitcoin’s legitimacy to some extent, proving the irreversibility of this trend.

Social Perspective: Social Darwinism

Bitcoin can actually be understood as an evolutionary tool.

Why do I say this? Those who can understand the endgame of Bitcoin can invest their wealth in it and, as Bitcoin spreads, gain huge returns, placing themselves at a higher level in the social food chain. Those who cannot comprehend this will see their wealth gradually diminish and find themselves at a disadvantage in society, losing their voice, and ultimately being gradually eliminated by society. It’s also a process of filtering out the foolish, aligning with social Darwinism.

Additionally, I’d like to quote a line from Game of Thrones to illustrate this point. “The world is not fair, and the rules are manipulated by people. Welcome to the era of rationality’s demise. Right and wrong don’t matter, no one cares. Join in, or be eliminated.” When the world reaches nuclear equilibrium, war is no longer the ultimate way to destroy populations. This more peaceful yet more brutal method offers everyone a chance, and every individual has the opportunity to determine their own fate, competing in terms of cognition, which ultimately leads to survival of the fittest.

Thus, Bitcoin can accelerate the evolution of human society, enabling it to reach Level 1 civilization sooner.

As Michael Saylor said, “Bitcoin is a network of wasps serving the goddess of wisdom, feeding on the fire of truth, and growing exponentially smarter, faster, and stronger behind the barriers of encrypted energy.”

Human Nature Perspective: Bitcoin Aligns with Human Nature

From the perspective of human nature, Bitcoin perfectly aligns with the essence of human nature. I have discussed this in my previous blog, the development of human society is essentially about stimulating individuals’ subjective initiative, allowing a small group of social elites to gain excess returns through creation, thus driving society forward.

According to Maslow's hierarchy of needs, individuals will prioritize fulfilling their basic survival needs, followed by higher needs like self-actualization. Survival needs are selfish, while self-actualization needs are altruistic. Therefore, human nature can be characterized as selfish. Only selfish individuals are considered normal, healthy individuals.

For Bitcoin’s early creators, evangelists, organizers, and participants, everyone hopes to gain excessive returns. Expanding this to the entire human society, no one wants to be the last to get involved in a Ponzi scheme, which is why, as Bitcoin becomes more widespread, more and more people will accept this concept and theory and participate in this grand Ponzi scheme. I want to emphasize that a Ponzi scheme is not necessarily a negative term. Human society is fundamentally built upon this. From the moment you are born, you are already involved in the Ponzi scheme of human society. Those who come earlier enjoy benefits, while latecomers must offer their wealth in exchange for the opportunity to do the same in the future. Only a few, called geniuses, can break the rules and create their own rules. Even then, they need time to accumulate. This is because educating the human group with facts takes time, and new rules need time to be accepted. Only by letting Bitcoin achieve new historical highs again and again will more and more people join the human group.

In summary, the creators of Bitcoin saw through human nature.

Data Perspective: Logarithmic Growth

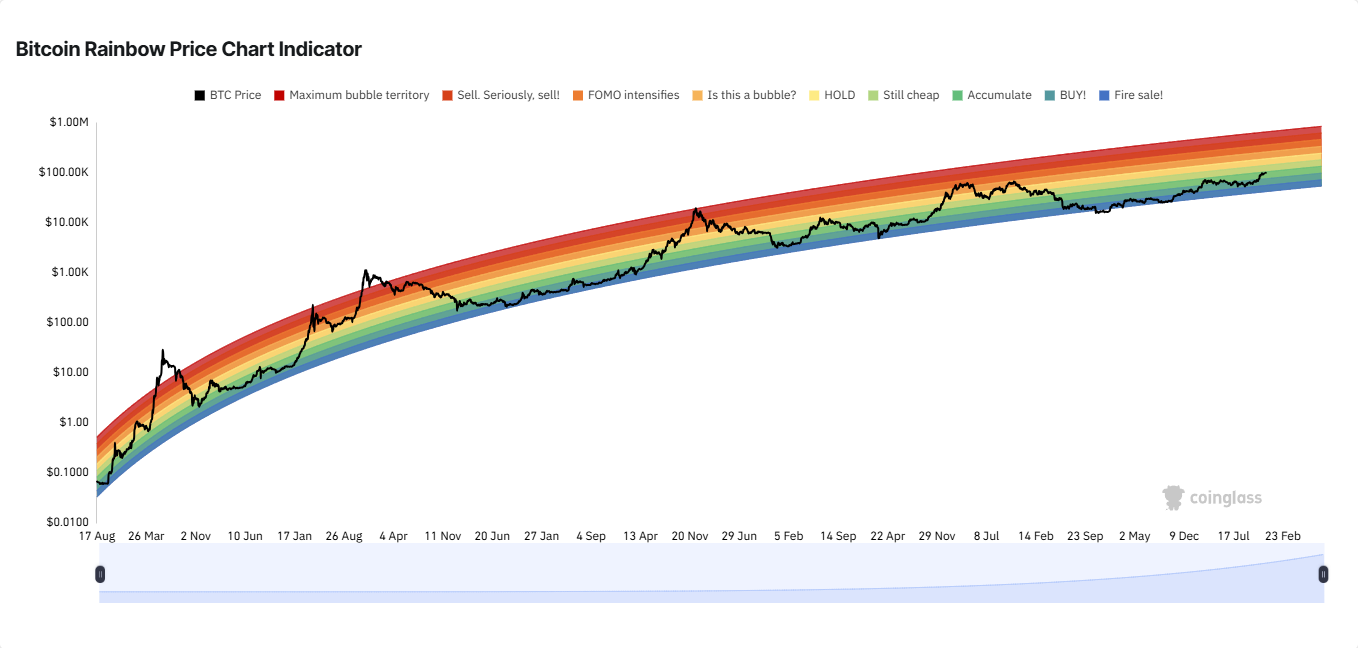

From the Bitcoin rainbow chart, we can clearly see that Bitcoin’s price fluctuates within a logarithmic range, which aligns perfectly with the expectation of global assets gradually participating.

This also supports several previous perspectives on Bitcoin. The conclusion is that Bitcoin is a global wealth reshuffling mechanism, filtering humanity through cognition.

The earlier participants gain more, and their returns grow logarithmically. There is still great development potential in the current stage.

According to preliminary estimates, the global population that can currently participate in Bitcoin transactions is at most around 500 million, while the total global population is approximately 8 billion. Bitcoin’s current market cap is about $2 trillion,

while global total assets are about $900 trillion. There is still a large amount of wealth that has not yet participated, so Bitcoin still holds enormous potential.

Response to Critics

Youtube - Buffett’s View on Bitcoin

Finally, I would like to address some opposing views, especially those of Buffett. His arguments can be summarized in three points:

1. Bitcoin is like tulips and gold, it is not a productive asset, cannot be accurately valued, and does not fit value investing.

2. Bitcoin is not unique, anyone can create a coin.

3. Bitcoin buyers are irrational, refusing to accept opposing views, and hope others will buy at a higher price.

These points seem reasonable at first glance, but they do not stand up to deeper scrutiny.

First, it is true that Bitcoin is not a productive asset and cannot be valued like stocks or bonds. But precisely because of this, Bitcoin has no upper price limit, or rather, Bitcoin’s price ceiling depends on the number of people who can use Bitcoin. Since it is a globally revolutionary creation, the wealth of the global population can participate, which cannot be valued by traditional financial models. Perhaps even Buffett himself has forgotten something he once said: liquidity is the most important thing for an asset.

Secondly, Bitcoin may not be unique, but high-quality assets are also not unique. Berkshire’s stock is not more valuable than stocks from other companies. As Carl Menger said, value is always subjective, and consensus mechanisms will make the minority obey the majority, educating the global human group through time accumulation.

Finally, to label the buyers of a financial product as irrational without justification makes Buffett seem a bit uncomfortable. Are all US stock investors absolutely rational value investors? We cannot deny that many things in the early stages of development are accompanied by great controversy, and when society reaches consensus, the opportunity for returns on that thing is already gone. Buffett mistakenly confused Bitcoin’s endgame with its current situation, leading to a wrong conclusion.

After watching the interview with Buffett, my biggest takeaway is: One can never earn money beyond their level of cognition. No matter what reason Buffett opposes Bitcoin, it doesn’t matter. What matters is to have independent thinking and understanding, maximizing the benefit of oneself as an individual in the development of human society.

I do not deny that Buffett is an investment master, but everyone has limitations. For example, Munger once apologized for a huge loss in Alibaba investments. No matter the reason Buffett and Munger deny Bitcoin, whether ignorance of their own ignorance or committing the error of empiricist dogmatism, it will not affect Bitcoin’s eventual success. Their criticism of Bitcoin will become the best example of how people become more stubborn as they age.

One day in the future, when Bitcoin becomes the world currency, we will look back at their interview videos and feel deeply nostalgic. So-called masters are just like everyone else. Do not blindly follow authority, dare to question, and analyze things from the perspective of logic and human nature. This is the most rational way of survival and the most primitive driving force for human progress.

Two Mainlines of Future Society

I came across an article on Toutiao that aligns with my views: in the coming decades, human development might revolve around two mainlines: the conflict between communism and liberalism. Artificial intelligence represents the efficiency and centralization of communism, while Bitcoin represents the decentralization and autonomy of liberalism. These two mainlines will profoundly affect our social structures and personal wealth freedom. For ordinary people, the best strategy is to lay out both sides. Period.

References

ChatGPT’s answer to “the value and time of existence of the state ideology”

Wikipedia definition of “Production Relations”